Categories

Attorneys

About Us

Federal & international areas: business tax planning, tax transactions, tax consulting, and tax controversy work for businesses, inter alia, partnerships, corporations, LLCs, and individuals.

Tax Services Overview: Business Tax Planning, Tax Returns, Tax Transactions, Consulting, and Controversy Work

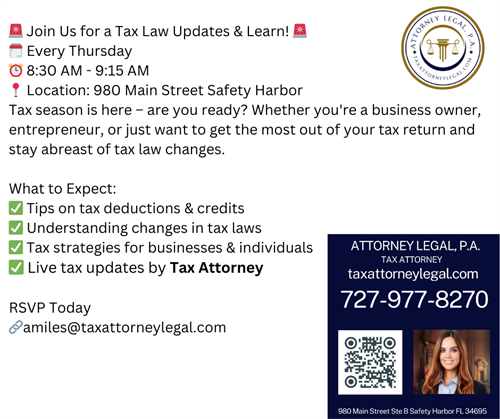

A comprehensive suite of tax services is offered for businesses and individuals, including tax return preparation, business tax planning, and international tax strategies. Services include:

Offer in Compromise (OIC): Settling IRS debt for less than owed.

Tax Audits: Representation during IRS audits.

Tax Return Preparation: Full-service tax return filing for individuals and businesses.

Business Tax Planning: Entity selection, deductions, credits, and M&A strategies.

Tax Transactions: Structuring asset and stock sales, mergers, and acquisitions.

Tax Consulting: Strategic planning, including cryptocurrency, international tax, and FATCA compliance.

Tax Controversy: Resolution through OIC, appeals, and litigation.

International Tax Services: Cross-border planning, FIRPTA, and transfer pricing.

Cryptocurrency Taxation: Reporting requirements for digital assets.

Foreign Accounts Compliance: Assistance with FATCA and FBAR obligations.

Clients are guided through tax-efficient strategies, ensuring compliance while minimizing liabilities, whether for partnerships, corporations, LLCs, or individuals.

Video Media

Images

Rep/Contact Info

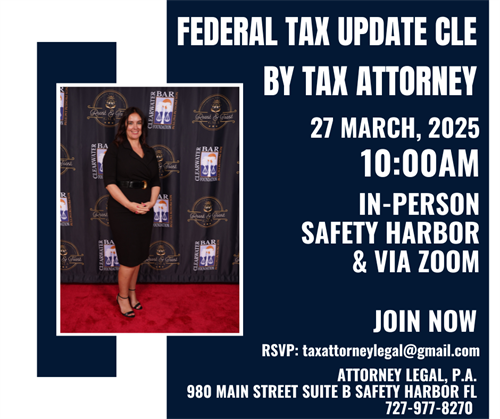

Alena Miles

President

- Phone: (727) 977-8270

- Cell Phone: (727) 698-0195

- Send an Email

- 980 Main Street Suite B Safety Harbor FL 34695